Land Investment: Own the Future Today!

Investing in land is one of the safest and most rewarding ways to grow your wealth. Land is limited, and its value tends to increase over time, making it a smart choice for long-term investment. Whether you're a beginner exploring real estate opportunities or an experienced investor seeking the best strategies, this guide will walk you through profitable land investments and the best investment strategies for 2025 to help you make informed decisions.

Why Land Investment is a Smart Choice

1. Limited Supply, Increasing Demand

Land is a finite asset, and as populations grow, the demand for land continues to rise. This natural scarcity makes it a valuable long-term investment.

2. Lower Maintenance Costs

Unlike rental properties that require ongoing maintenance and management, land investment is relatively hassle-free. You don’t have to deal with tenants, repairs, or property management issues.

3. Strong Appreciation Potential

Historically, well-located land appreciates significantly over time, offering investors substantial returns. Strategic locations near expanding cities, highways, or business hubs tend to experience faster value appreciation.

4. Multiple Profit Opportunities

Land investment offers various ways to generate income:

- Buy and Hold: Purchase land and sell it later at a higher price.

- Land Development: Build residential or commercial properties for higher returns.

- Agricultural Leasing: Lease land for farming, solar panels, or commercial use.

Best Investment Strategies for 2025

1. Invest in High-Growth Areas

Location is key in real estate. Research upcoming urban developments, commercial expansions, and infrastructure projects to identify regions with high growth potential. Look for areas near new highways, airports, or tech hubs, as they tend to attract investors and businesses.

2. Buy Land with Future Development Potential

Land near growing cities or upcoming projects like industrial zones, tech parks, or commercial districts tends to appreciate quickly. Government-planned developments often indicate strong future value growth.

3. Diversify Your Land Investments

Instead of putting all your money into a single piece of land, consider diversifying by investing in:

- Residential plots in developing areas

- Agricultural land for leasing or organic farming

- Commercial land in business districts

4. Consider Land Flipping

Land flipping—buying undervalued land and selling it at a higher price—can be highly profitable if done correctly. Look for distressed or underpriced properties, improve them (clearing, legal documentation, zoning changes), and sell at a premium.

5. Understand Legal and Zoning Regulations

Before purchasing land, check its zoning laws, title deeds, and legal restrictions to ensure smooth ownership and future usability. Always verify land documents and consult legal experts if needed.

6. Invest in Sustainable and Eco-Friendly Land Projects

With the rise of green energy projects, organic farming, and eco-tourism, investing in sustainable land can be a lucrative strategy in 2025. Consider land suitable for solar farms, reforestation projects, or organic agriculture.

How to Get Started with Land Investment

1. Set Clear Investment Goals

Define your budget, expected returns, and investment timeline to determine the type of land that aligns with your financial objectives.

2. Conduct Thorough Research

Use online platforms, real estate reports, and local property advisors to analyze market trends, price fluctuations, and investment risks.

3. Work with Real Estate Experts

Engage with real estate agents, property lawyers, and financial advisors to avoid legal issues and ensure a smooth investment process.

4. Secure Financing (If Needed)

If you require financing, explore bank loans, real estate investment funds (REITs), or private lenders that specialize in land investment loans.

5. Perform On-Site Inspection

Visit the land before purchasing to check for accessibility, nearby developments, and possible zoning restrictions. Physical inspection helps avoid investment pitfalls.

Common Mistakes to Avoid in Land Investment

1. Ignoring Market Research

Failing to analyze market demand, growth potential, and pricing trends can lead to poor investment decisions.

2. Overlooking Legal Aspects

Ensure the land has clear ownership, no disputes, and proper documentation before purchasing.

3. Investing Without a Strategy

Randomly buying land without a clear investment plan can lead to low returns and long holding periods.

Conclusion

Land investment remains one of the most profitable and secure investment options for 2025 and beyond. By choosing the right location, diversifying your investments, and understanding legal aspects, you can maximize your returns and build long-term wealth. Whether you’re a beginner or an experienced investor, the key to success lies in strategic planning, thorough research, and making well-informed decisions.

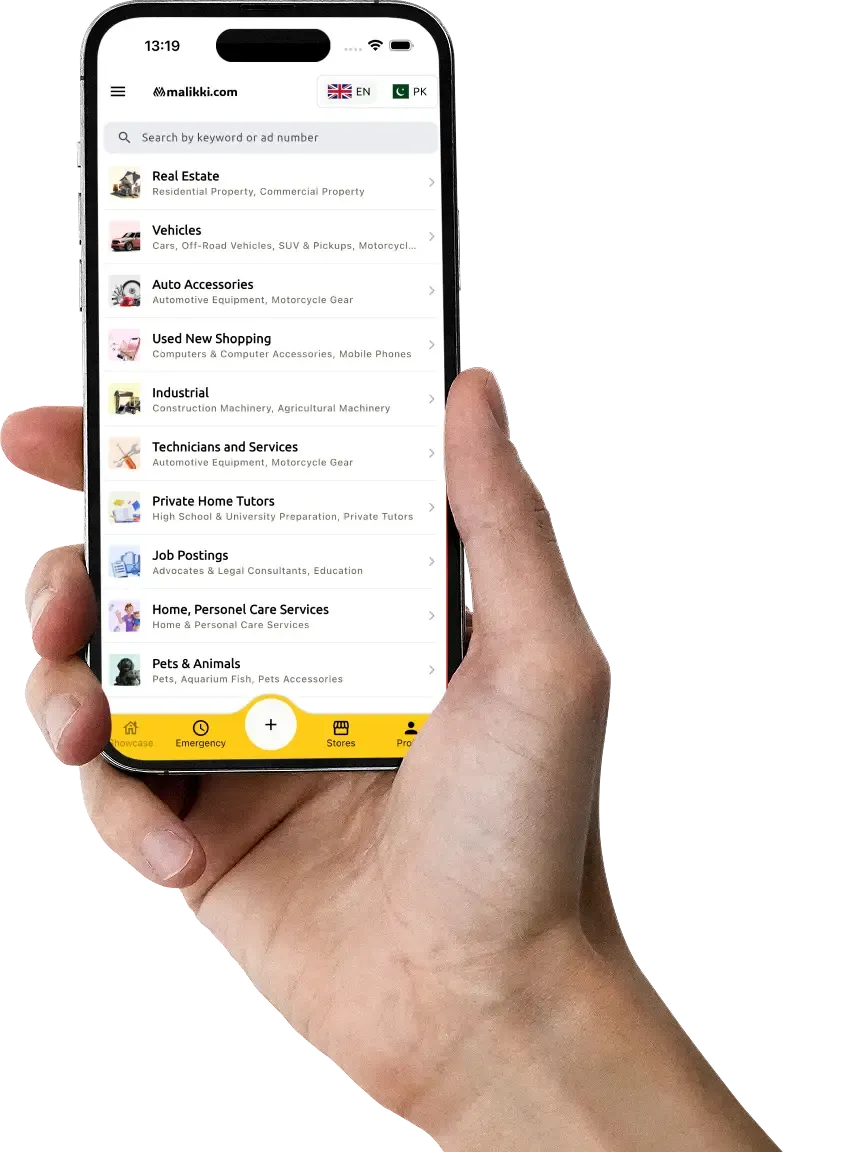

Are you ready to own the future? Start your land investment journey today with Malikki! Explore our marketplace for land listings and secure a profitable tomorrow.