The Role of Digital Payments in Growing Pakistan’s E-Commerce

The rapid growth of e-commerce in Pakistan has transformed the way people buy and sell products. With the increasing use of the internet and smartphones, online shopping is becoming a preferred choice for many consumers. However, one of the key drivers behind this transformation is the rise of digital payments. Secure and convenient payment methods are not only boosting consumer confidence but also enabling businesses to expand their reach. In this blog, we will explore the role of digital payments in accelerating the growth of Pakistan’s e-commerce industry.

The Growth of E-Commerce in Pakistan

Pakistan’s e-commerce industry has seen remarkable growth in recent years. With an increasing number of businesses shifting online, the demand for reliable payment solutions has surged. Some of the factors contributing to this growth include:

- Rising Internet Penetration: More people in Pakistan are gaining access to the internet, making online shopping more convenient.

- Smartphone Usage: Affordable smartphones have made it easier for consumers to browse and shop online.

- Government Support: The State Bank of Pakistan (SBP) and other regulatory bodies are encouraging digital financial inclusion.

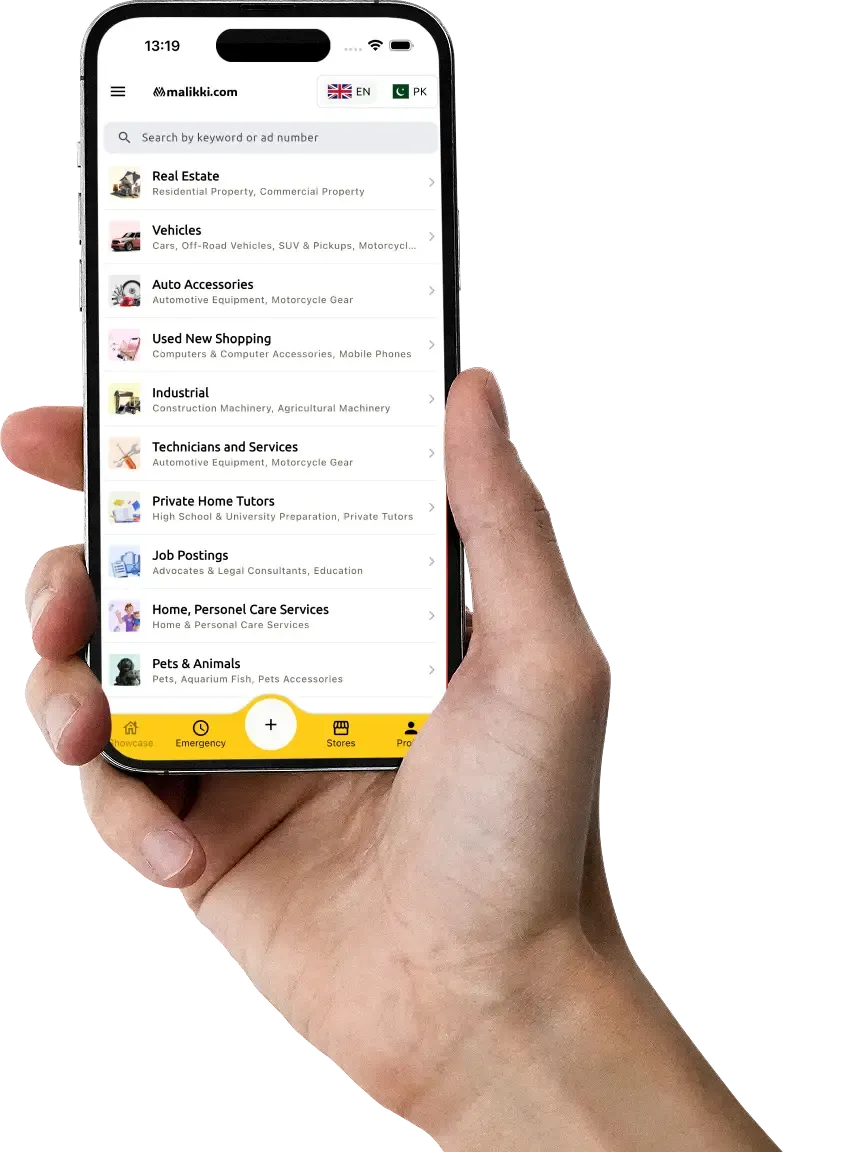

- Expansion of Online Marketplaces: Platforms like Daraz, Telemart, and Malikki have made online shopping more accessible and popular.

The Role of Digital Payments in E-commerce Growth

Digital payments have played a crucial role in the expansion of e-commerce in Pakistan. Here’s how:

1. Enhancing Convenience for Consumers

Traditional cash-on-delivery (COD) methods have long dominated online shopping in Pakistan. However, digital payments provide a hassle-free alternative, allowing consumers to make instant payments using credit/debit cards, mobile wallets, and bank transfers. The simplicity of digital payments encourages more people to engage in online shopping.

2. Building Trust and Security

One of the biggest concerns in online shopping is security. Digital payment solutions, such as secure payment gateways and encryption technologies, help protect consumers from fraud. Platforms like EasyPaisa, JazzCash, and PayFast provide secure transactions, increasing consumer trust in e-commerce.

3. Reducing Dependence on Cash

Cash-based transactions come with risks, including theft and delayed deliveries. Digital payments eliminate the need for cash handling, making transactions seamless and efficient. Businesses benefit by reducing operational costs and minimizing cash-related errors.

4. Supporting Business Growth

For businesses, digital payments offer a faster and more reliable way to receive payments. Automated transactions help online sellers improve cash flow management and scale their operations. Small businesses, in particular, can benefit from integrating digital payment solutions to reach a wider audience.

5. Boosting Cross-Border E-Commerce

With digital payments, Pakistani businesses can expand beyond local markets and tap into international e-commerce. Payment solutions like Payoneer and PayPal (where available) enable cross-border transactions, allowing businesses to cater to global customers.

Popular Digital Payment Methods in Pakistan

Several digital payment options are gaining popularity among Pakistani consumers and businesses:

- Mobile Wallets: EasyPaisa, JazzCash, SadaPay

- Bank Transfers: Online banking apps from major banks like HBL, Meezan, and UBL

- Credit/Debit Cards: Visa, Mastercard, and UnionPay

- Payment Gateways: PayFast, Keenu, and 1LINK

Challenges in Digital Payment Adoption

Despite the advantages, digital payments in Pakistan still face some challenges:

- Limited Awareness: Many consumers and small businesses are unfamiliar with digital payment options.

- Security Concerns: Fear of online fraud prevents some users from adopting digital payments.

- Internet Accessibility Issues: In rural areas, limited internet access slows down the adoption of online transactions.

- Preference for Cash: Many consumers still prefer COD due to a lack of trust in online payments.

The Future of Digital Payments in Pakistan

The future of digital payments in Pakistan looks promising. The government and fintech companies are actively working to promote cashless transactions. With improved infrastructure, better regulations, and increasing consumer trust, digital payments are expected to further drive the growth of e-commerce in the country.

Conclusion

Digital payments have become an essential part of Pakistan’s e-commerce ecosystem. By offering security, convenience, and efficiency, they are enabling businesses to grow and consumers to shop with confidence. As digital payment solutions continue to evolve, they will play an even greater role in shaping the future of Pakistan’s e-commerce industry. Embracing this transformation is key to ensuring a seamless and thriving online marketplace for everyone.